property tax on leased car in ct

The terms of the lease will decide the responsible party for personal property taxes. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name.

What S The Car Sales Tax In Each State Find The Best Car Price

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

. To calculate the property tax multiply the assessment of the property by the mill rate and. The due date of the tax is usually January 1. This means that if you purchase a new vehicle in Connecticut then you will have to pay an additional 635 of the final purchase price of the vehicle.

While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. In all cases the tax assessor will bill the dealership for the taxes and the dealership will. This page describes the taxability of.

Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax. Even if the vehicle is not. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your.

In all cases the tax advisor charges the taxes to the. If you terminate your lease it. The terms of the lease decide which party is responsible for the personal property tax.

All tax rules apply to leased vehicles. For example if your. Owners of vehicles registered between October 2 and July 31 pay a prorated amount depending on the date of registration of the vehicle.

Once you have both of these pieces of information you can calculate your vehicle property tax by multiplying the value of your vehicle by the mill rate. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. The local property tax is computed and issued by your local tax collector.

The local car tax is 1812 if the price is 18200 x 70. In California the sales tax is 825 percent. A dealer who rents a vehicle retains ownership.

So if you live in a state with a.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Insuring A Leased Vehicle Bankrate

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

What You Should Know About Short Term Car Leases Forbes Advisor

401 W Main St Norwich Ct 06360 Loopnet

Leasing Vs Buying A Car Pros And Cons Travelers Insurance

The Top Do You Pay Property Tax On Leased Vehicles In Ct

Tangible Personal Property State Tangible Personal Property Taxes

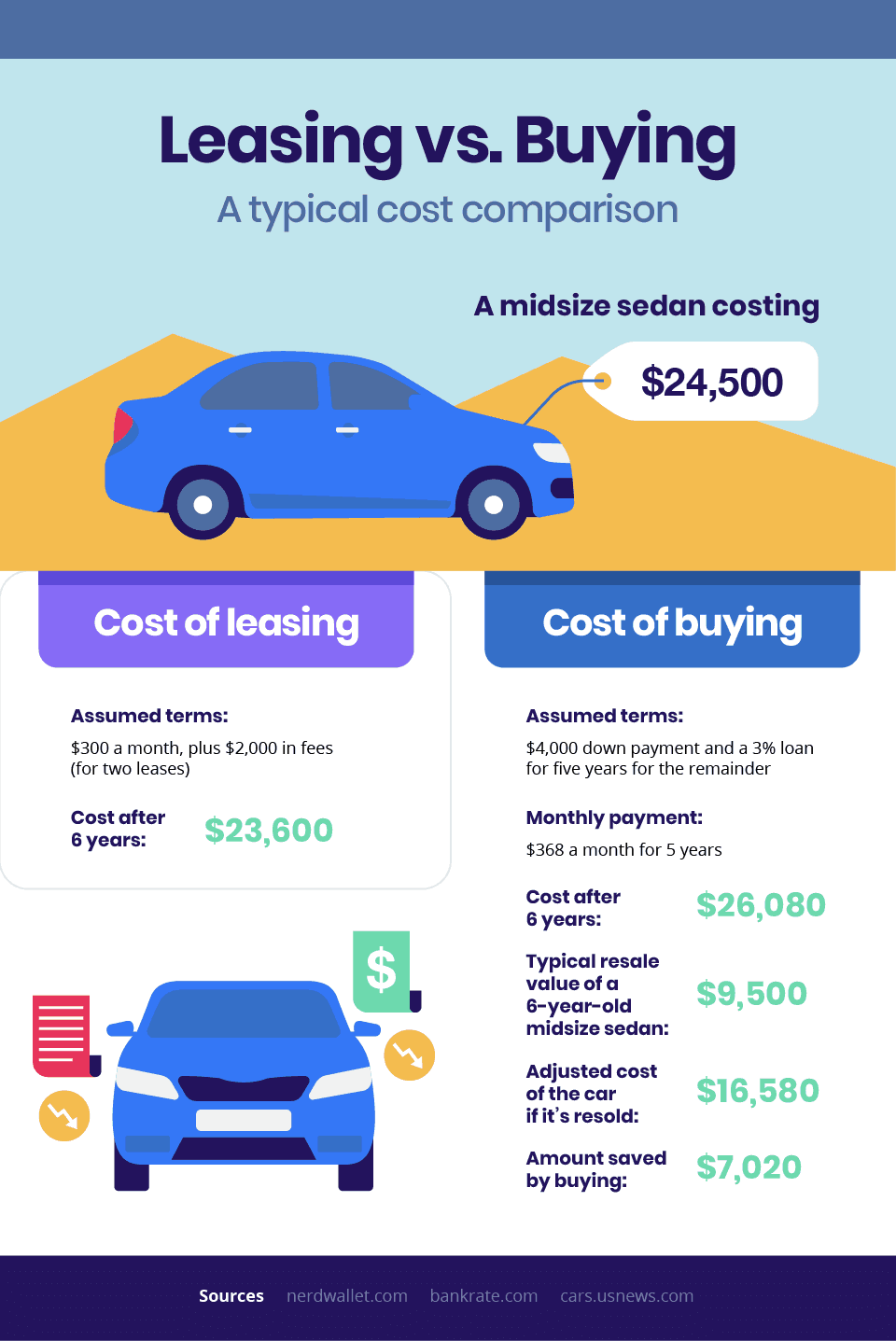

Is It Better To Buy Or Lease A Car Taxact Blog

Leasing A Car And Moving To Another State What To Know And What To Do

250 Pomeroy Ave Meriden Ct 06450 Loopnet

Nj Car Sales Tax Everything You Need To Know

3091 S Jamaica Ct Aurora Co 80014 Loopnet

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Bentley Lease Specials Miller Motorcars New Bentley Dealership In Greenwich Ct

Who Pays The Personal Property Tax On A Leased Car

.jpeg)

Can You Trade In A Car That S Still On A Lease Here S How Shift