nebraska sales tax rate on vehicles

For vehicles that are being rented or leased see see taxation of leases. Web Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

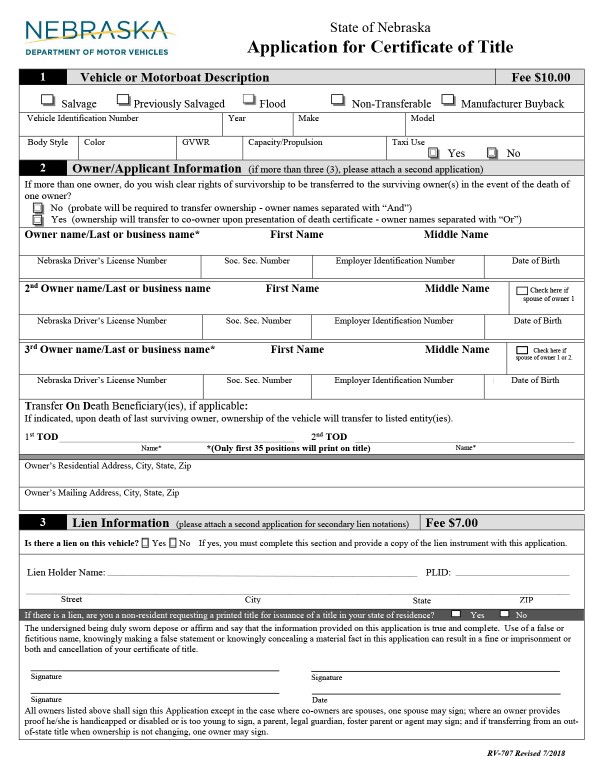

Vehicle Registration Nebraska Department Of Motor Vehicles

Web Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

. Web This page covers the most important aspects of Nebraskas sales tax with respects to vehicle purchases. Buying a car doesnt. 60000 Sales Tax Rate.

Web Nebraska only charges the regular sales tax rate on motor vehicle rentals. In addition to taxes car purchases in Nebraska. Web In Douglas County 18 percent is retained by the county and 22 percent distributed to the appropriate city including Omaha.

60000 Sales Tax Rate. Web The Nebraska state sales and use tax rate is 55 055. This value includes both state and local taxes and the latter varies based on the county.

However local governments can charge up to 575 percnet of the contract amount as a county rental fee. After 1 is retained by the County Treasurer and 1 is distributed to the V ehicle Title and Registration System. Web The tax is in addition to Nebraskas 55 percent sales tax rate.

Web Calculate Car Sales Tax in Nebraska Example. Money from this sales tax goes towards a whole host of state-funded projects and programs. Web The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska.

In Nebraska the sales tax percentage is 55. The maximum tax that can be charged is 325 dollars. Web The Nebraska state sales and use tax rate is 55 055.

So whilst the Sales Tax Rate in Nebraska is 55 you. Web The Nebraska sales tax on cars is 5. Web The distribution of funds collected for the Motor Vehicle Tax are.

Web The motor vehicle tax on the other hand is based on a progressive schedule that charges an increasing percentage tax burden as the value of a new passenger vehicle increases. This example vehicle is a passenger truck registered in Omaha purchased for. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023.

NE. Registration Year Base Tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska.

Web The Dakota County sales and use tax rate is only applicable in areas that are outside of municipalities in Dakota County with their own local sales and use tax. A room that is 100 for the night would be 11250 once the business adds taxes. Web Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item.

Web Nebraska and Local Sales and Use Tax Return - All-Terrain Vehicles ATVs and Utility-Type Vehicles UTV for County Treasurers Lessors of ATVs UTVs Motorboats or. Web Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The average car sales tax for Nebraska is 6324.

The cost to register your car in. If there is no municipality in the location where the. Web Local Sales Tax.

Taxes And Spending In Nebraska

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Used Cars In Nebraska For Sale Enterprise Car Sales

Nebraska Sales And Use Tax Nebraska Department Of Revenue

St Paul Increases Sales Tax For New Fire Station

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To File And Pay Sales Tax In Nebraska Taxvalet

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

All About Bills Of Sale In Nebraska The Forms And Facts You Need

A Twenty First Century Tax Code For Nebraska Tax Foundation

Free Nebraska Bill Of Sale Forms 4 Pdf Eforms

How To File And Pay Sales Tax In Nebraska Taxvalet

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Tax Laws By State Ultimate Guide For Business Owners