north carolina estate tax return

PO Box 25000 Raleigh NC 27640-0640. NC K-1 Supplemental Schedule.

Online Tax Services Guilford County Nc

North Carolina Department of Transport.

. North Carolina Department of Revenue. Complete this version using your computer to enter the required. 1 for Estates Trust will begin.

E-File is available for North Carolina. Preparation of a state tax return for North Carolina is available for 2995. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

In North Carolina this document is often combined with a Living Will to answer questions regarding end of life decisions. Youll need to file a final income tax return for the decedent. Work Opportunity Tax Credit.

Beneficiarys Share of North Carolina Income Adjustments and Credits. In fact the IRS does not have an inheritance tax while some states do have one. Taxpayers who filed before the Jan.

The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same. File Pay Taxes. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to.

North Carolina Department of Revenue. Allocation of Income Attributable to Nonresidents. It is not intended to.

Your average tax rate is 1198 and your. Up to 25 cash back Update. File income tax returns.

The exemption amounts match those allowable on the Federal estate tax return - 5000000 in 2011 and 5120000 in 2012 - before the North Carolina estate tax is computed. North Carolina Income Tax Calculator 2021. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

The estate will need its own tax. And lastly doing the tax returns of the deceased and the tax. 2021 D-407 Estates and Trusts Income Tax Return.

Individual income tax refund inquiries. The information included on this website is to be used only as a guide in the preparation of a North Carolina individual income tax return. So if you live in N.

2021 D-407 Web-Fill Versionpdf. 11 opening for Corporate returns and Feb. Carolina but inherit assets.

You may also need to file an income tax return for the estate. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Tax Bulletins Directives Important Notices.

North Carolina has no inheritance tax or gift tax. The federal gift tax has an annual exemption of. Previous to 2013 if a North Carolina resident died.

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. The agency began accepting Estate Trust tax returns on Feb. Owner or Beneficiarys Share of NC.

Last Minute Tax Tips North Carolina Estate Planning Blog

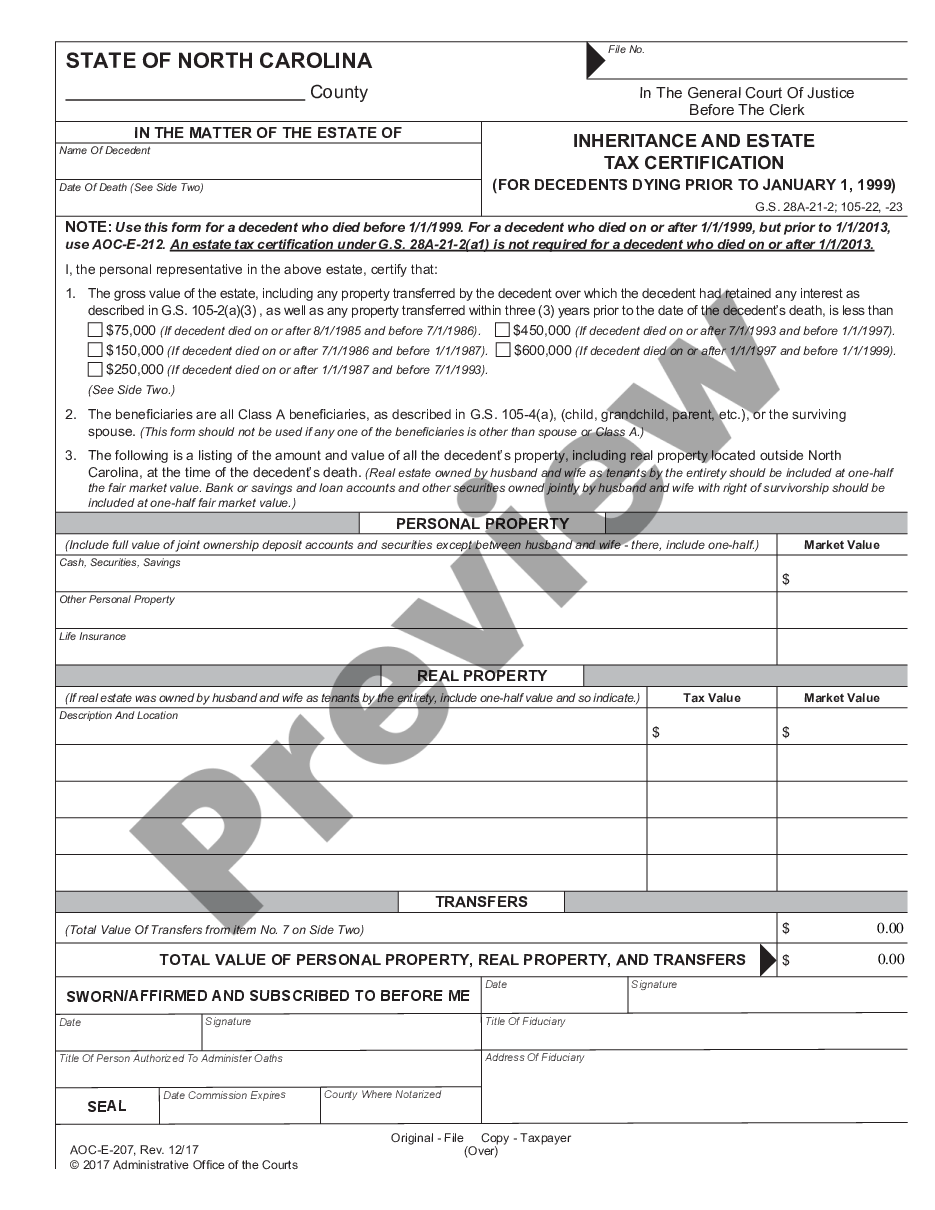

Form A 101 Estate Tax Return Web Fill In

Moved South But Still Taxed Up North

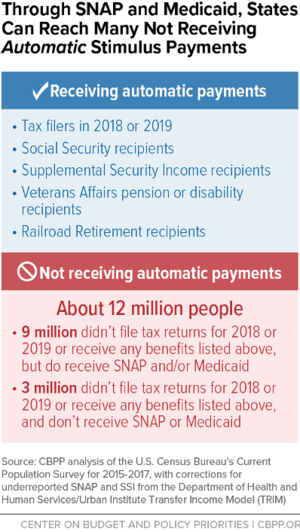

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

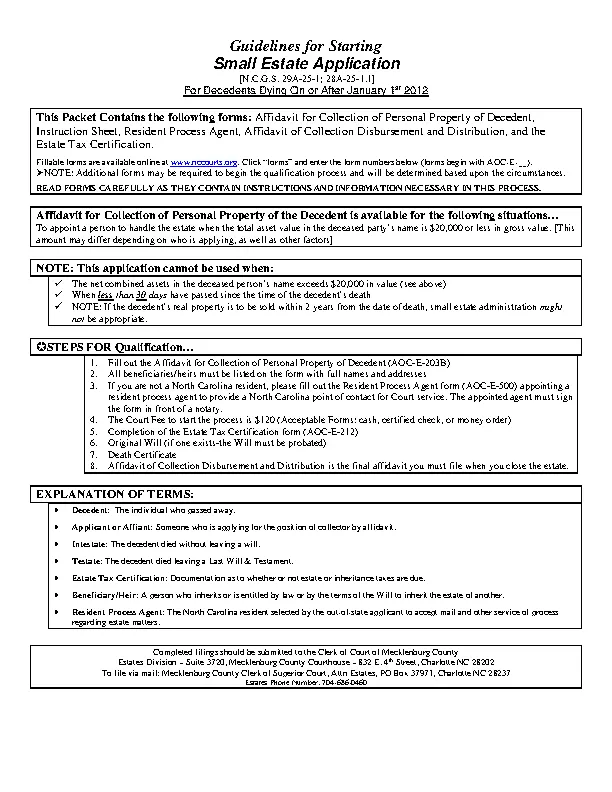

North Carolina Small Estate Packet Pdfsimpli

Guilford County Tax Department Guilford County Nc

North Carolina Estate Tax Our Top Strategies Irs Pitfalls

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Journal Of The House Of Representatives Of The General Assembly Of The State Of North Carolina 1997 1998 Extra Session State Publications Ii North Carolina Digital Collections

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

A Guide To North Carolina Inheritance Laws

Understanding The Estate Tax Return Marotta On Money

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Understanding North Carolina Inheritance Law Probate Advance

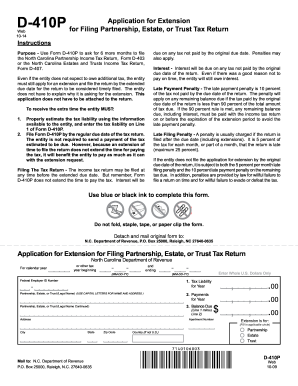

North Carolina D 410p Fill Out And Sign Printable Pdf Template Signnow

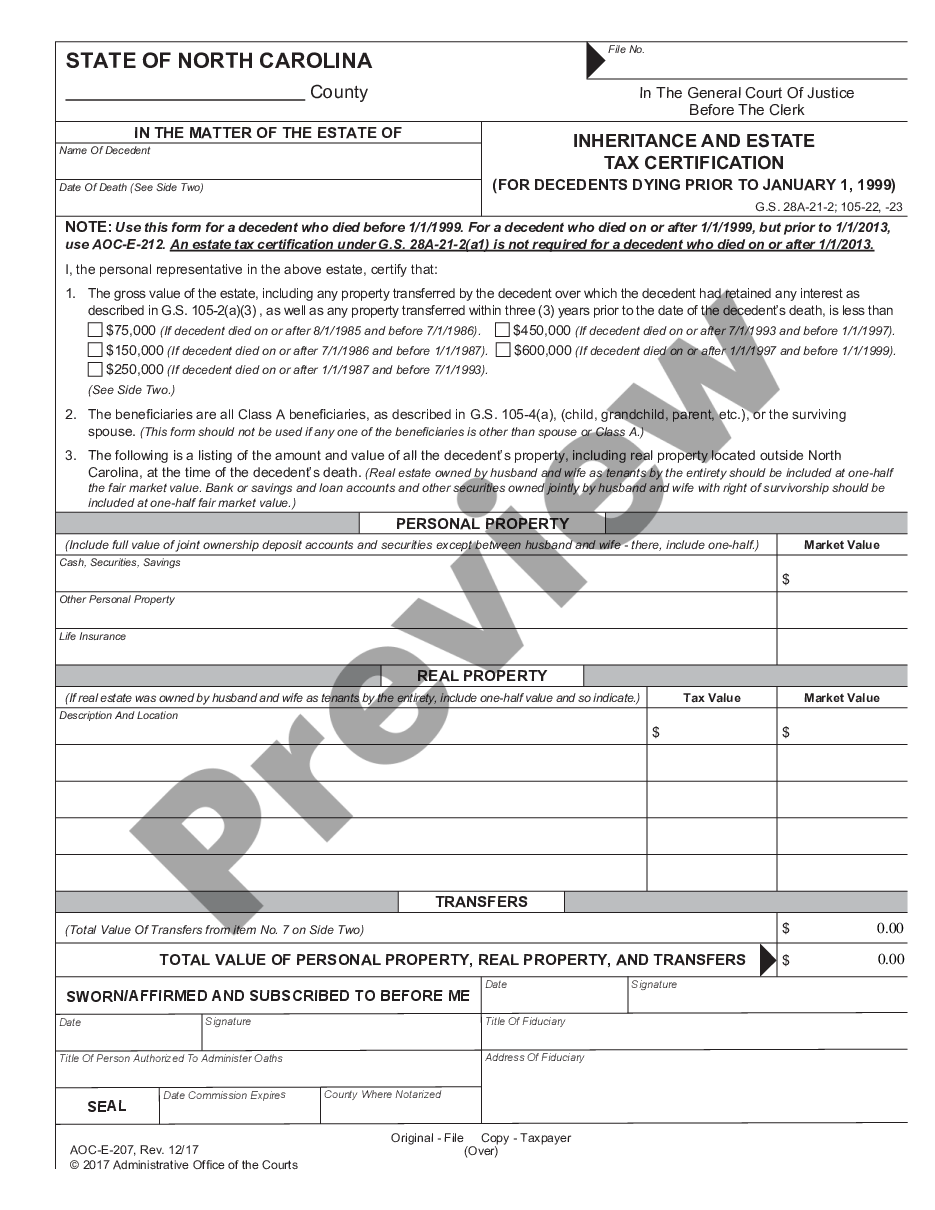

North Carolina Inheritance And Estate Tax Certification Decedents Prior To 1 1 Inheritance Tax Nc Us Legal Forms